Opinion / The Effects of War on the Real Estate Industry: Analysis and Case Studies

The Effects of War on the Real Estate Industry: Analysis and Case Studies

Published Date: June 11, 2024 - By Ebadul Haque

There are ups and downs in every sector; real estate is not an exception at all. From my extensive experience as a professional real estate data analyst, I’ve observed how various macroeconomic factors influence the industry. One of the most profound influences, albeit an unfortunate one, is war.

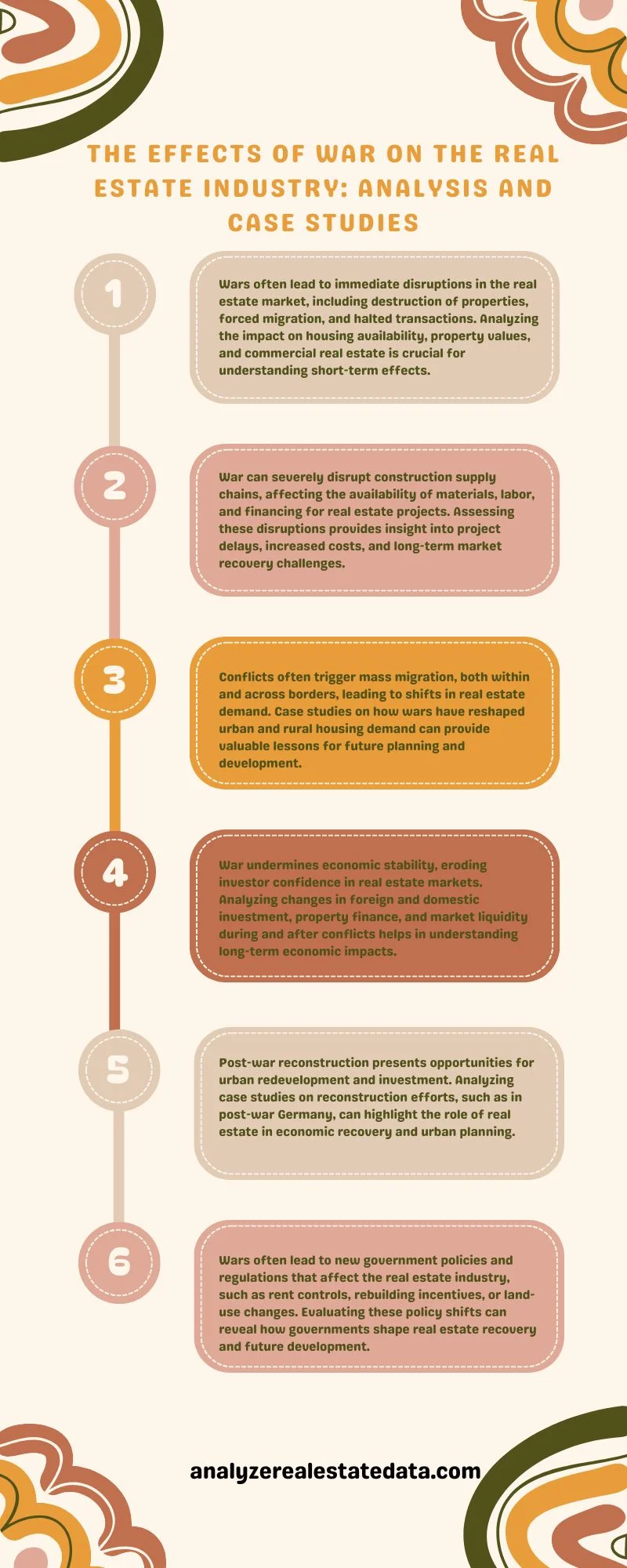

The effects of war on the real estate industry are multifaceted and can lead to both immediate and long-term consequences. In this analysis, I will draw from historical data and real-world examples to provide a comprehensive understanding of how war impacts the real estate sector.

I want to start by talking about the immediate effects. One of the most direct effects of war is the physical destruction of property. Historical examples, such as the extensive bombing during World War II, show how entire cities can be shattered, leading to a massive loss of residential and commercial properties.

More recent conflicts, such as those in Syria and Ukraine, have also demonstrated similar destructive impacts. In Syria, for instance, the civil war has resulted in the destruction of a large share of the country’s housing stock, according to UN-Habitat reports. This destruction displaced populations and created a sudden and severe shortage of habitable real estate.

It’s undeniable that war often forces people to flee conflict zones, which ultimately leads to significant population displacement. For example, the Syrian conflict has resulted in millions of refugees seeking asylum in neighboring countries and beyond.

This displacement not only depresses the real estate market in war-torn regions but also places increased demand on housing markets in receiving areas. In Germany, the influx of Syrian refugees led to a notable uptick in demand for affordable housing, which subsequently caused rental prices to surge in several cities.

The war brings economic instability, which in turn affects the real estate market. Economic uncertainty makes both consumers and investors wary. Historical data from the Lebanese Civil War (1975–1990) illustrates this point. During this period, Lebanon’s GDP dismantled, and its real estate market stagnated due to the prevailing economic uncertainty.

Post-war periods often see extensive efforts in urban redevelopment and reconstruction, which require substantial investment. The reconstruction of Europe post-World War II, particularly through initiatives like the Marshall Plan, revitalized many war-torn cities, incorporating modern infrastructure and planning techniques that improved long-term real estate value.

Past data and analysis show that in the immediate aftermath of conflict, property markets become highly distorted. Speculation drives up prices artificially. Policies aimed at stabilizing the post-war economy, providing housing for displaced populations, and incentivizing investment in reconstruction significantly influence market recovery.

For instance, Japan’s post-World War II economic policies facilitated rapid industrial growth and urbanization, which had a positive long-term impact on its real estate market. Berlin is an exemplary case of a city profoundly affected by war and its subsequent recovery. Post-World War II, Berlin was in ruins. The division of the city into East and West Berlin created distinct real estate markets with differing dynamics.

In West Berlin, supported by the Marshall Plan, rapid reconstruction led to modernized infrastructure and a booming real estate market. In contrast, East Berlin, under Soviet control, experienced slower growth and less investment.

The reunification of Berlin in 1990 again transformed the real estate market, leading to a significant boom as investors sought opportunities in the formerly underdeveloped eastern parts of the city.

Sarajevo’s recovery from the Bosnian War (1992–1995) provides another insightful example. The war caused extensive damage to Sarajevo’s infrastructure and housing. Post-war reconstruction efforts, supported by international aid, focused on rebuilding residential areas and commercial centers.

Over the past two decades, Sarajevo has experienced substantial real estate development, transforming war-ravaged neighborhoods into vibrant urban districts. The city’s recovery highlights the potential for war-impacted areas to bounce back with effective planning and investment.

Now let’s point out insurance, which plays a crucial role in mitigating the financial risks associated with war. War-risk insurance can provide property owners with financial protection against damage or loss caused by conflict.

However, such insurance is often expensive and may not be available in all conflict zones. Encouraging the broader availability and affordability of war-risk insurance could help stabilize real estate markets in conflict-prone areas.

For investors, diversification is key to managing the risks associated with war. Investing in real estate across various regions and property types can help mitigate the impact of localized conflicts. Real estate investment trusts (REITs) offer a way to achieve such diversification, allowing investors to spread their risk across a broader portfolio of properties.

In addition, proactive government and international interventions are critical. Policies that promote economic stability, provide incentives for reconstruction, and support displaced populations can help real estate markets recover more quickly. International organizations and foreign governments can also play a vital role by providing financial aid, technical assistance, and investment in reconstruction projects.

By the way, the effects of war on the real estate industry are profound and multifaceted. It encompasses immediate destruction, displacement, and economic instability. It also causes long-term impacts like reconstruction, market distortion, and the influence of government policies.

From my experience, it is clear that war can devastate real estate markets and strategic planning. Investment can facilitate recovery and even create opportunities for modernization and growth. Understanding these dynamics is crucial for investors, policymakers, and stakeholders in the real estate industry to navigate the complex landscape shaped by conflict.

ezLandlordForms, a trusted USA-based company, offers all the tools you need to manage your property effectively. With their state-specific leases, tailored to comply with local laws, and comprehensive tenant screening services, you can ensure your property is in the best hands. Whether you’re managing on your own or seeking professional help, ezLandlordForms provides the resources to make property management simple and stress-free.