Blog / How to Analyze a Rental Property Deal with DealCheck? Step-by-step Guidelines

How to Analyze a Rental Property Deal with DealCheck? Step-by-step Guidelines

Published Date: September 14, 2024 - By Ebadul Haque

“Successful real estate investing is built on data, not guesswork. DealCheck empowers you to turn numbers into knowledge, helping you make confident, profitable decisions every time.”

Analyzing a rental property deal is a critical step for any real estate investor, and using a tool like DealCheck can simplify the process. If you’re planning to invest in real estate, understanding how to accurately analyze a deal with DealCheck ensures that you make smart financial decisions.

In this tutorial, I will show you how to analyze a rental property deal with DealCheck, estimating profits, expenses, and long-term projections. Follow the below steps to get your job successfully done:

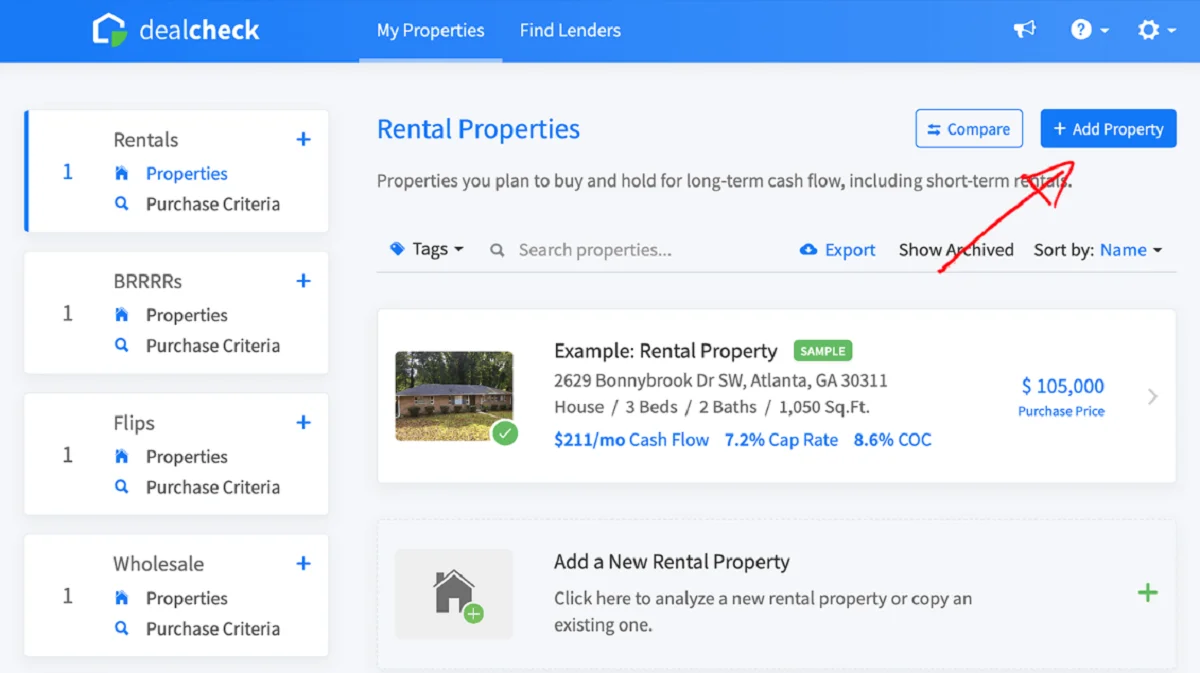

Step 1: Navigate to the Rentals List

First, go to the “Rentals” list on your dashboard. Then click the “Add Property” button located at the top right of the screen.

Step 2: Select the Enter Manually Option

Once a pop-up appears, choose the “Enter Manually” option to launch the step-by-step wizard that will guide you through entering all the necessary details for your property.

Step 3: Fill in the Property Description

Enter the details about your rental property in this section. The most important fields to fill in are:

Name: Enter the name of the property or an identifier for easy reference.

Tags & Labels: Add tags or labels to categorize the property for quick access.

Address: Provide the complete address of the property.

Property Type: Choose the type of property.

Description: Write a brief description of the property.

Step 4: Enter the Purchase & Rehab Information

In this section, you will need to input all relevant financial details regarding the property purchase and any planned rehab work. Key fields include:

Purchase Price: Enter the total purchase price of the property.

After Repair Value: Estimate the property’s value after completing any repairs.

Financing: Input any financing details, such as loans or mortgages.

Purchase Costs: Include all costs and fees associated with purchasing the property.

Rehab Costs: Estimate the total cost of repairs or renovations.

Step 5: Enter the Rent & Expenses Information

Next, fill in details regarding expected rental income and ongoing expenses. Important fields to complete are:

Gross Rent: Estimate the total gross rent you expect to collect.

Vacancy: Input a percentage to account for potential vacancy periods.

Other Income: Include any additional income sources you expect to receive.

Expenses: Enter the anticipated recurring expenses like property management, taxes, insurance, maintenance, and utilities.

Step 6: Customize Long-Term Projections

This section helps you forecast the long-term performance of your rental property. Be sure to fill in the following fields:

Appreciation: Input your estimate for annual property appreciation.

Income Increase: Estimate the annual increase in rental income.

Expense Increase: Estimate the annual increase in operating expenses.

Selling Costs: Enter a percentage for the costs associated with selling the property in the future.

Depreciation: Add any depreciation you plan to claim for tax purposes.

Refinancing: Include any potential refinancing details to reflect on your projections.

Step 7: Get the Complete Analysis Overview

Once you have entered all the necessary information, click on the “Property Analysis Page.” This will provide a comprehensive overview of your property, including cash flow, purchase breakdown, cap rate, return on investment (ROI), and other financial metrics.

Step 8: View Buy & Hold Projections

Finally, click the “Buy & Hold Projections Page” to view projections for holding the property over the long term. This will help you evaluate potential future profits and equity growth over time.

That’s all you need to adhere to. By following these steps, you can efficiently analyze any rental property deal using DealCheck, ensuring that you make informed decisions based on accurate financial data.

Whether you’re a seasoned real estate investor or just starting your journey, DealCheck is the tool you need to confidently analyze rental properties, flips, and multi-family deals. With its easy-to-use interface and powerful analytics, you can quickly estimate profits, calculate cash flow, and project long-term returns—all in just a few clicks.

Sign up for DealCheck now and gain access to the most reliable real estate analysis software that helps you find the best deals and maximize your ROI. Make smarter, data-driven choices for your future and achieve your financial goals faster!

Why Should You Analyze a Rental Property with DealCheck?

When investing in real estate, analyzing a rental property helps you understand its cash flow potential, expenses, and long-term profitability. DealCheck allows you to calculate all crucial metrics to make an informed decision and succeed in your project. Key metrics you can learn from the bulk analysis of DealCheck are:

Cash Flow: Estimate how much income you’ll generate after expenses.

Return on Investment (ROI): Measure how much profit you’ll make relative to your investment.

Cap Rate: Understand the relationship between net operating income and the property’s purchase price.

Cash-on-Cash Return: Analyze the annual return on the actual cash invested.

Break-Even Ratio: See how much income is needed to cover expenses.

Key Features of DealCheck for Investors That Make It Stand Out:

DealCheck stands out because it allows you to customize assumptions, track properties over time, and integrate market data. The platform offers:

Real-Time Market Comparisons: Compare your property with similar ones to ensure your investment is competitive.

Customizable Loan & Financing Options: Experiment with different financing structures to see how they impact ROI.

Long-Term Projections: Easily model the financial outcome of holding a property for 5, 10, or even 30 years.

Side-by-Side Comparisons: Analyze multiple properties at once to find the best deal.

Common Mistakes to Avoid When Analyzing a Rental Property with DealCheck:

While DealCheck makes it easier to run the numbers, there are common pitfalls you should avoid:

Overestimating Rental Income: Be realistic about the potential rent you can charge. Consider vacancy rates and local market conditions.

Underestimating Expenses: Don’t forget to include property taxes, insurance, repairs, and management fees in your expense calculations.

Ignoring Financing Costs: Ensure you account for interest rates, down payments, and loan terms, as these factors can drastically impact your bottom line.

Whether you’re a seasoned real estate investor or just starting your journey, DealCheck is the tool you need to confidently analyze rental properties, flips, and multi-family deals. With its easy-to-use interface and powerful analytics, you can quickly estimate profits, calculate cash flow, and project long-term returns—all in just a few clicks.

Sign up for DealCheck now and gain access to the most reliable real estate analysis software that helps you find the best deals and maximize your ROI. Make smarter, data-driven choices for your future and achieve your financial goals faster!

Final Words: DealCheck’s Value for Real Estate Investors

Using DealCheck for analyzing rental property deals can save you time and help you make data-driven decisions. Its user-friendly dashboard, detailed financial analysis, and customizable projections provide all the tools you need to evaluate a deal’s profitability.

Whether you are looking to flip houses, buy rental properties, or invest in multi-family buildings, DealCheck gives you a competitive edge by simplifying the process and providing accurate projections for both short-term gains and long-term investments.

By leveraging DealCheck’s features and understanding the key metrics involved in real estate analysis, you can confidently assess property deals and ensure they align with your investment goals. However, as you know how to analyze a rental property deal with DealCheck, it’s time to kick-start your journey with it.

FAQs:

What is DealCheck and how can it help me analyze rental properties?

DealCheck is an online real estate analysis tool that allows you to evaluate rental properties, BRRRR deals, flips, and multi-family buildings. It simplifies the process by helping you estimate profits, cash flow, ROI, and long-term projections. It provides a detailed financial overview of potential investments, allowing you to make data-driven decisions.

How do I add a new rental property in DealCheck?

To add a new rental property, go to the “Rentals” section on the dashboard and click the “Add Property” button. Select the “Enter Manually” option to input property details step by step, including the purchase price, rental income, expenses, and rehab costs.

What key metrics should I focus on when analyzing a rental property with DealCheck?

Important metrics to consider include Net Operating Income (NOI), Cash Flow, Return on Investment (ROI), Cap Rate, Cash-on-Cash Return, and so on.

Can I customize financing options within DealCheck?

Yes, DealCheck allows you to customize financing details such as loan amounts, interest rates, down payments, and loan terms. You can also experiment with different financing structures to see how they impact cash flow and overall ROI.

How can I use DealCheck to analyze long-term projections?

In the “Long-Term Projections” section, you can estimate future appreciation, rent increases, expense increases, and selling costs. DealCheck provides tools to model how these factors will affect the property’s financial performance over time, helping you forecast profits and equity growth for 5, 10, or even 30 years.

What does the Property Analysis page show me?

The “Property Analysis” page provides a detailed overview of the property’s performance, including metrics like cash flow, ROI, cap rate, and total profits. It also displays a breakdown of income and expenses, helping you see exactly where your money is going.

Can I compare multiple properties using DealCheck?

Yes, DealCheck allows you to compare multiple properties side-by-side. You can analyze several deals simultaneously to determine which property offers the best financial returns, making it easier to find the most profitable investment.

How accurate are the estimates provided by DealCheck?

DealCheck’s estimates are as accurate as the data you input. It’s essential to provide realistic and well-researched figures for rental income, vacancy rates, rehab costs, and market conditions. You can also adjust assumptions like appreciation rates and financing terms to create more precise projections.

Is DealCheck suitable for beginners in real estate investing?

Yes, DealCheck is designed to be user-friendly, making it ideal for both beginners and experienced investors. Its step-by-step wizard guides you through the straightforward process of analyzing a property.

Article Disclaimer: This article provides general information about real estate and is not professional advice. Consult with a qualified professional before making any decisions. The creator is not liable for errors, omissions, or outcomes based on the information presented. Readers should always agree to seek personalized advice before making any real estate transactions.

Affiliate Disclosure: Please note that I am an affiliate marketer. This means I may earn a small commission at no extra cost to you if you purchase through my affiliate link. I only recommend products and services that I believe will bring value to you. Thank you for supporting my recommendations and allowing me to continue offering valuable content.