Opinion / Data Analytics and Insights: Informed Decision-Making in Real Estate

Data Analytics and Insights: Informed Decision-Making in Real Estate

Published Date: June 16, 2024 - By Ebadul Haque

In the fast-paced world of real estate, where every decision can mean the difference between profit and loss, data analytics has emerged as a game-changer. As a seasoned real estate data analyst, I’ve had the privilege of witnessing how harnessing data analytics can transform the industry landscape. Let me share a story that illustrates the power of data analytics in real estate.

Last year, I worked with a mid-sized real estate firm that was struggling to stay competitive. They were making decisions based on gut feelings and outdated information, often missing out on lucrative opportunities. One day, the firm’s owner approached me with a challenge: “Help us leverage data to improve our decision-making process.”

We began by integrating various data sources—market trends, property values, rental yields, and demographic information—into a centralized analytics platform. One of the first insights we uncovered was a significant shift in rental demand patterns.

Through data analysis, we discovered that millennials were increasingly preferring urban areas with access to public transportation and amenities. This was contrary to the firm’s focus on suburban properties.

Armed with this insight, we shifted our investment strategy to target urban areas. One particular neighborhood, which had been overlooked due to its previous reputation, emerged as a hidden gem.

The data showed a steady increase in new businesses, improved safety records, and rising demand for rental units. We acquired several properties in this area at competitive prices, and within a year, rental incomes surged by 25%.

Another example involved pricing strategies for property sales. Traditional methods relied heavily on comparative market analysis, which often missed nuanced market shifts. By utilizing predictive analytics, we could forecast future property values based on variables like economic indicators, infrastructure projects, and population growth.

This approach allowed us to price properties more accurately and optimize our selling strategies. One notable success was a commercial property that, according to our predictive model, would appreciate significantly due to a planned transit development. We advised the client to hold off on selling for six months, resulting in a 15% higher sale price.

Data analytics also played a crucial role in risk management. We developed a risk assessment model that evaluated potential investments against factors such as market volatility, tenant default rates, and maintenance costs. This model helped us avoid several high-risk investments that, although tempting, could have resulted in substantial financial losses.

However, our risk model highlighted significant flood risks and projected maintenance costs due to climate change impacts. We did advise our client against the purchase, a decision that saved them from considerable future expenses as the area experienced severe flooding the following year.

Beyond investment decisions, data analytics improved our operational efficiency. By analyzing maintenance request patterns, we identified properties with recurring issues, enabling us to address root causes proactively rather than reactively. This not only reduced maintenance costs by 20% but also enhanced tenant satisfaction and retention rates.

The integration of data analytics in real estate isn’t just about crunching numbers; it’s about uncovering stories hidden within the data. These stories guide us in making strategic decisions, optimizing investments, and mitigating risks. My journey with the real estate firm is a testament to the transformative power of data.

As technology advances, the potential for data analytics in real estate continues to grow. Machine learning algorithms can now predict market trends with unprecedented accuracy, and big data platforms provide real-time insights that were once unimaginable.

For anyone in the real estate industry, embracing data analytics isn’t just an option—it’s a necessity for staying competitive and making informed decisions.

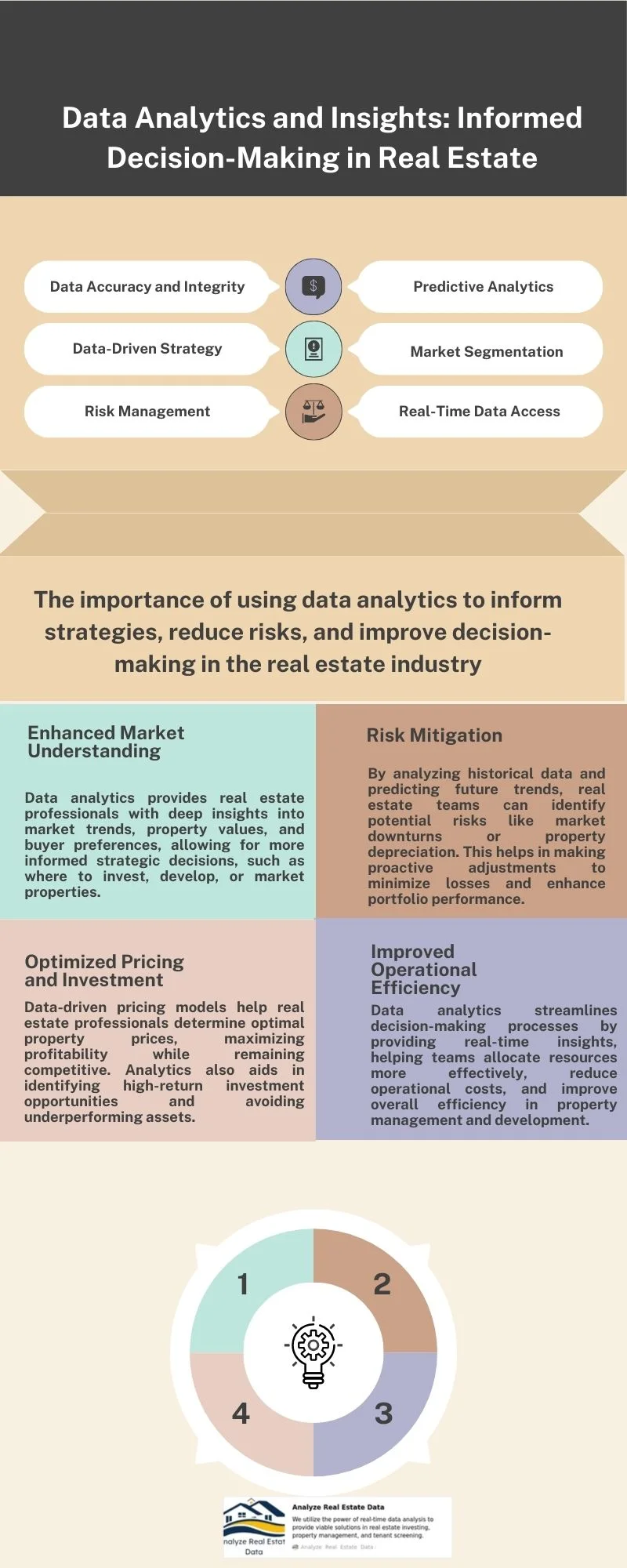

In conclusion, data analytics have revolutionized the way we approach real estate. By leveraging data, we can uncover hidden opportunities, optimize pricing strategies, manage risks, and improve operational efficiency. As a real estate data analyst, I can confidently say that informed decision-making powered by data is the future of this industry.

Ready to take your real estate investments to the next level? FlipperForce is your all-in-one house flipping software, designed to help you analyze deals, manage rehab projects, and maximize your profits. Whether you’re a seasoned investor or just starting out, FlipperForce gives you the tools you need to succeed. Don’t leave your next flip to chance—sign up today and see how FlipperForce can streamline your projects and boost your returns!