Blog / The Investor’s Guide to Advanced Real Estate Financial Models and Analytics

The Investor’s Guide to Advanced Real Estate Financial Models and Analytics

Published Date: June 3, 2024 - By Ebadul Haque

Real estate financial models incorporate data inputs, assumptions, and calculations to forecast cash flows, investment returns, and other financial metrics over a specific time horizon. Common types of real estate financial models include discounted cash flow (DCF) analysis, income capitalization models, and cash flow projections.

Real estate financial models and analytics are systematic approaches and methodologies used to evaluate, predict, and optimize the financial performance of real estate investments. These models and analytics involve the use of quantitative techniques, software tools, and data analysis. They assist investors, developers, and managers in making informed decisions regarding real estate assets.

However, if you’re a real estate investor or someone interested in this industry, you can master these advanced concepts to improve your overall investment performance. As a professional data analyst, I can guide you through the best avenue, explaining the terms and necessity of all these concepts and analytics. Without further ado, let’s dive in!

Note: You can check out “Real Estate Investment & Financial Analysis,” a comprehensive guide that explores real estate as a pivotal asset class influencing global economies and individual investors alike. The book provides an in-depth analysis of finance and investment concepts pertinent to real estate, illustrating its increasing integration with capital markets.

Advanced Real Estate Financial Models and Analytics Concepts for Investors:

By leveraging all the advanced models and analytics, you can make more informed investment decisions and enhance your understanding of market dynamics. Here’s a detailed explanation of what they entail:

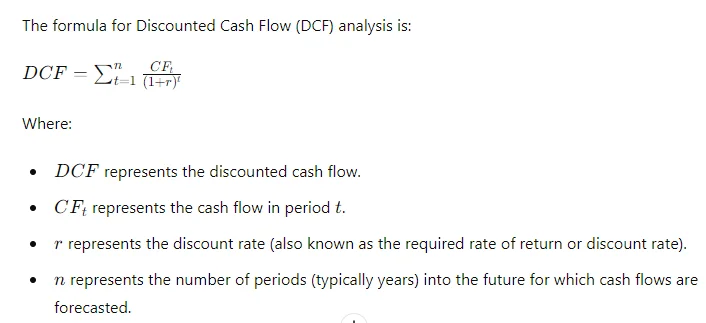

Discounted Cash Flow (DCF) Analysis:

Discounted Cash Flow (DCF) analysis is indispensable for real estate investors due to its ability to provide a precise valuation of properties. By projecting future cash inflows and outflows and discounting them to their present value, DCF analysis accounts for the time value of money, ensuring that investors understand the true worth of a property.

This method allows investors to make informed decisions about buying, holding, or selling properties by revealing whether a property is undervalued or overvalued in the market. Additionally, the detailed cash flow projections used in DCF analysis help investors anticipate the long-term financial performance of an asset, aligning investment choices with their financial goals and strategies.

Net Present Value (NPV):

Net Present Value (NPV) is a fundamental tool for real estate investors as it provides a clear measure of an investment’s viability. By calculating the difference between the present value of cash inflows and outflows over a property’s holding period, NPV allows investors to assess whether a property will generate sufficient returns.

A positive NPV indicates that the investment is expected to yield a profit above the required rate of return, making it an attractive opportunity. Conversely, a negative NPV suggests that the investment may result in a loss, guiding investors away from potentially unprofitable ventures. This straightforward yet powerful metric helps investors prioritize projects that align with their financial goals and risk tolerance.

Innago is a user-friendly property management software solution designed to save property owners and managers both time and money. By streamlining everyday tasks, Innago simplifies the rental management process with features like automated rent collection, tenant screening, and maintenance tracking. The intuitive platform allows users to efficiently manage multiple properties from one centralized dashboard.

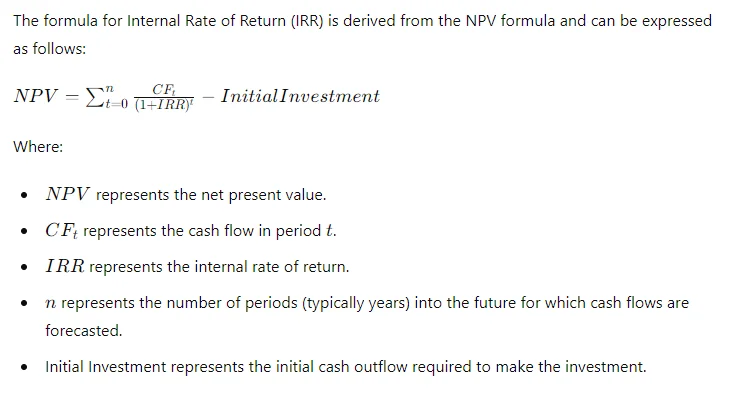

Internal Rate of Return (IRR):

Internal Rate of Return (IRR) is a crucial metric for real estate investors as it provides a comprehensive measure of an investment’s profitability and efficiency. The IRR represents the discount rate at which the net present value (NPV) of all cash flows, both inflows and outflows, from a property equals zero. Essentially, it indicates the expected annualized rate of return on an investment.

For real estate investors, IRR is indispensable because it allows for the comparison of the profitability of different properties and investment opportunities, regardless of their size or duration. A higher IRR suggests a more profitable investment, making it a key criterion in the decision-making process.

Sensitivity Analysis:

Real estate investors can understand how changes in key assumptions impact the financial performance of an investment with sensitivity analysis. This analysis involves varying critical inputs, such as rental rates, vacancy rates, operating expenses, and interest rates, to see how sensitive the property’s projected cash flows and returns are to these fluctuations.

The necessity of sensitivity analysis lies in its ability to provide a clearer picture of an investment’s risk profile. It helps investors prepare for different scenarios, ranging from best-case to worst-case situations, enabling them to make more informed decisions. Additionally, sensitivity analysis aids in stress testing the investment under various economic conditions, ensuring that investors are not caught off guard by market volatility.

Monte Carlo Simulation:

Monte Carlo simulation is essential for real estate investors because it provides a sophisticated method to assess and manage the uncertainty and risks associated with property investments. This technique uses statistical modeling to simulate a wide range of possible outcomes by randomly varying key input variables, such as rental rates, vacancy rates, interest rates, and property appreciation.

By running thousands of simulations, investors can generate a probability distribution of potential returns, offering a comprehensive picture of the investment’s risk and return profile. The necessity of Monte Carlo simulation lies in its ability to quantify and visualize the impact of uncertainty on an investment’s financial performance.

Realtyna provides flexible, scalable, and affordable web and mobile application solutions tailored to the needs of the real estate industry. Whether you’re a small agency or a large real estate firm, Realtyna’s innovative technology empowers you to enhance your online presence and streamline your operations. With customizable IDX and MLS integration, you can showcase property listings in real time, offering your clients a seamless browsing experience.

Real Options Analysis:

Unlike traditional valuation methods that assume a static set of conditions, real options analysis recognizes the value of managerial flexibility to adapt, expand, delay, or abandon projects based on evolving market conditions and new information. This approach is particularly important in real estate, where investments often involve significant capital and long-term commitments in uncertain environments.

By incorporating real options analysis, investors can better assess the value of maintaining flexibility and making strategic decisions that maximize returns and minimize risks. This method helps investors capture additional upside potential while protecting against downside risks, leading to more resilient and adaptable investment strategies.

Lease Modeling and Analysis:

Lease modeling and analysis are essential for real estate investors, as they provide a detailed understanding of how lease agreements impact a property’s financial performance. By examining lease terms such as rent escalations, renewal options, tenant improvement allowances, and expense reimbursements, investors can accurately forecast cash flows and assess the property’s income stability.

This analysis helps identify potential risks and opportunities associated with tenant leases, enabling investors to make informed decisions about property acquisition, management, and disposition. Furthermore, lease modeling allows investors to evaluate the creditworthiness of tenants and the impact of lease expirations on occupancy and revenue.

Capital Structure and Financing Strategies:

Capital structure and financing strategies are paramount for real estate investors, as they play a pivotal role in determining the overall profitability and risk profile of an investment. By carefully considering the optimal mix of debt and equity financing, investors can leverage their resources to maximize returns while minimizing costs and risks.

This involves evaluating various financing options, such as mortgage loans, mezzanine financing, and equity partnerships, to determine the most cost-effective and flexible capital structure for a particular property or portfolio. Moreover, financing strategies extend beyond initial acquisitions to encompass ongoing capital management and refinancing decisions throughout the investment lifecycle.

Start maximizing your real estate potential today with REIPro, a versatile, intuitive, and cutting-edge piece of software. With features that simplify deal analysis and contact management, REIPro empowers you to find and close more deals efficiently. Say goodbye to scattered tools and hello to a streamlined, powerful platform that elevates your real estate investing game. Choose REIPro and watch your investments soar.

Portfolio Optimization:

It enables real estate investors to strategically allocate their capital across a diversified collection of properties to achieve their investment objectives while managing risk. By carefully selecting a mix of properties with varying characteristics, such as location, asset type, and risk profile, investors can create a portfolio that maximizes returns while minimizing volatility.

Moreover, portfolio optimization involves balancing risk and return objectives to achieve the optimal risk-adjusted return. By using quantitative techniques such as mean-variance optimization, investors can identify the combination of properties that offers the highest expected return for a given level of risk. This ensures that the portfolio is aligned with the investor’s risk tolerance and financial goals.

Market Analysis and Forecasting:

Market analysis and forecasting provide critical insights into current market conditions and future trends, allowing investors to make informed decisions and capitalize on opportunities. By examining key market indicators such as supply and demand dynamics, economic trends, population growth, and demographic shifts, investors can assess the attractiveness of different property markets and identify potential investment opportunities.

Market analysis enables investors to understand the underlying drivers of real estate values and rental rates, helping them to identify markets with strong growth potential and favorable investment fundamentals. Moreover, market forecasting helps investors anticipate future market trends and potential risks, enabling them to proactively adjust their investment strategies and mitigate downside risks.

Advanced Valuation Techniques:

Advanced valuation techniques are essential for real estate investors as they provide more nuanced and accurate assessments of property value, enabling investors to make informed decisions and optimize their investment strategies. While traditional valuation methods like comparable sales or income capitalization are valuable, advanced techniques offer deeper insights into complex real estate assets and market conditions.

One such technique is the hedonic pricing model, which evaluates property value based on specific attributes such as location, size, amenities, and condition. Another advanced valuation technique is the repeat sales model, which analyzes the price changes of the same property over time to estimate appreciation rates.

Real Estate Investment Trust (REIT) Analysis:

Real Estate Investment Trust (REIT) analysis offers a unique opportunity to access diversified real estate assets and generate steady income with the benefits of liquidity and tax advantages. Conducting a thorough REIT analysis allows investors to evaluate the performance, growth prospects, and risk profile of REITs before making investment decisions.

REIT analysis involves examining important financial metrics such as funds from operations (FFO), net operating income (NOI), occupancy rates, and debt levels to gauge the REIT’s profitability, cash flow generation, and ability to cover distributions to shareholders. Understanding these metrics helps investors assess the REIT’s ability to generate consistent income and deliver long-term value appreciation.

Tax Considerations and Optimization:

Tax considerations and optimization have a significant impact on investment returns and overall profitability. Real estate investments offer various tax advantages and incentives that investors can leverage to maximize after-tax returns and minimize tax liabilities.

One key consideration is depreciation, which allows investors to deduct the cost of acquiring income-producing properties over time. By depreciating the property’s value, investors can reduce taxable income and defer taxes, effectively increasing cash flow and overall returns on investment.

Environmental, Social, and Governance (ESG) Factors:

Environmental, social, and governance (ESG) factors have become increasingly important for real estate investors as they seek to align their investments with sustainability goals, social responsibility, and good governance practices. Incorporating ESG considerations into investment decisions is not only a matter of ethical responsibility but also crucial for mitigating risks, enhancing asset performance, and maximizing long-term value.

Environmental factors, such as energy efficiency, carbon footprint, and sustainable building practices, are critical considerations for real estate investors as they impact operating costs, regulatory compliance, and asset resilience. Properties with high ESG performance are often more attractive to tenants, investors, and regulators, leading to higher occupancy rates, lower vacancy risk, and increased property values.

Machine Learning and Big Data Analytics:

Machine learning and big data analytics enable the extraction of valuable insights from vast amounts of data, leading to more informed investment decisions and enhanced portfolio performance. By leveraging advanced algorithms and computational techniques, investors can analyze complex datasets, identify patterns, and predict market trends with greater accuracy and efficiency.

One key application of machine learning and big data analytics in real estate investing is predictive modeling, which allows investors to forecast property values, rental rates, and occupancy trends based on historical data and market indicators. These predictive models enable investors to anticipate market fluctuations, assess investment risks, and optimize portfolio allocation strategies, ultimately improving investment outcomes.

Scenario Planning and Stress Testing:

Scenario planning and stress testing supply valuable tools for assessing and managing risks, identifying vulnerabilities, and preparing for potential market disruptions. In an inherently dynamic and uncertain real estate market, the ability to anticipate and adapt to various scenarios is crucial for safeguarding investments and maximizing long-term returns.

Scenario planning involves creating and analyzing multiple hypothetical scenarios to assess the potential impact of different economic, market, and regulatory conditions on real estate investments. By considering a range of plausible scenarios, investors can identify key drivers of risk and uncertainty, evaluate their potential effects on investment performance, and develop proactive strategies to mitigate risks and capitalize on opportunities.

Unlock the full potential of your real estate business with REISift, the premier CRM solution that transforms the way professionals scale their sales and marketing efforts. With REISift, you can achieve exceptional growth through healthy data management, ensuring your leads and contacts are organized and actionable. Focus your sales strategy with precision using REISift’s advanced tools that streamline workflows and enhance productivity.

Key Components of a Real Estate Financial Model:

A real estate financial model typically comprises several key components that help investors evaluate the financial performance and viability of a property investment. These components may vary depending on the complexity of the model and specific investment objectives, but common elements include:

Real estate analytics involve the use of statistical analysis, data visualization, and other analytical techniques to interpret and derive insights from real estate data. This may include market research, property valuations, risk assessments, and performance benchmarking.

Property Details:

This section includes basic information about the property, such as its address, type (residential, commercial, or industrial), size, zoning classification, and any unique features or amenities.

General Assumptions:

Assumptions are fundamental to the financial model and include various factors that drive revenue and expenses, such as rental rates, occupancy levels, operating expenses, capital expenditures, financing terms, and market growth rates. These assumptions are typically based on historical data, market research, and expert judgment.

Income Statement:

The income statement projects the property’s revenue, expenses, and net operating income (NOI) over a specific time horizon, typically ranging from one to ten years. It includes line items such as rental income, other income, operating expenses, and NOI.

Cash Flow Statement:

The cash flow statement outlines the property’s cash inflows and outflows, including operating cash flow, debt service payments, capital expenditures, and distributions to investors. It provides a detailed view of the property’s liquidity and ability to generate positive cash flow.

Financing Assumptions and Sources:

This section includes details about the financing structure of the investment, including loan terms, interest rates, loan-to-value (LTV) ratio, debt service coverage ratio (DSCR), and any other financing terms or conditions. It also outlines the sources of financing, such as mortgages, equity contributions, or other forms of capital.

Scenario Analysis:

Scenario analysis evaluates the financial impact of different scenarios or market conditions on the investment. Investors may analyze best-case, base-case, and worst-case scenarios to assess the range of potential outcomes and develop risk mitigation strategies.

Graphs and Charts:

Graphs and charts are often used to visually represent key financial metrics, trends, and analysis results. Common graphs include time-series charts of revenue, expenses, and cash flow, as well as sensitivity analysis charts and scenario analysis graphs.

Revenue Projections:

Revenue projections in real estate are fundamental to understanding the financial performance and viability of an investment property. These projections estimate the income generated by the property over a specific period, typically ranging from one to ten years, and serve as a cornerstone for investment analysis and decision-making.

Capital Expenditures:

Capital expenditures are crucial investments made to acquire, maintain, or enhance the physical assets of a property. These expenditures encompass significant one-time expenses that contribute to the long-term value and functionality of the property. Examples of capital expenditures include renovations, structural repairs, system upgrades, and additions to the property.

Operating Expenses:

Operating expenses are the ongoing costs associated with owning and operating a property. These expenses are incurred regularly to maintain the property’s day-to-day operations, ensure tenant satisfaction, and preserve its value. Operating expenses encompass a wide range of expenditures, including but not limited to property taxes, utilities, maintenance and repairs, property management fees, and administrative expenses.

Debt Financing:

Debt financing is a common strategy used by real estate investors to acquire properties, fund development projects, and capitalize on investment opportunities. In debt financing, investors borrow funds from lenders, such as banks, financial institutions, or private lenders, in exchange for agreeing to repay the principal amount plus interest over a specified period.

Are you ready to take control of your house flipping projects? FlipperForce is the ultimate web-based tool for house flippers, rehabbers, and real estate investors. Analyze deals with precision, manage your rehab projects efficiently, and ensure every flip is a success. Don’t let opportunities slip through the cracks—equip yourself with FlipperForce and start flipping with confidence.

Final Words:

Real estate financial models and analytics refer to tools and techniques used by investors, developers, lenders, and other stakeholders to analyze and evaluate real estate investments. These models and analytics provide quantitative insights into various aspects of real estate investments, including financial performance, risk assessment, market trends, and investment strategies.

Together, real estate financial models and analytics help investors make informed decisions about real estate investments by providing quantitative insights into key factors affecting investment performance. By applying real estate financial models and analytics concepts, you can assess the profitability, risk, and feasibility of real estate investments. I hope the provided information will come in handy in your professional life.

FAQs: The Investor’s Guide to Advanced Real Estate Financial Models and Analytics

What are advanced real estate financial models, and why are they important for investors?

Advanced real estate financial models are sophisticated analytical tools used to assess investment opportunities, forecast cash flows, and evaluate the financial performance of real estate assets. These models incorporate various factors, such as market trends, financing options, and property valuations. They are crucial for investors as they provide deeper insights into potential risks and returns, enabling informed decision-making and strategic planning in the competitive real estate market.

How can analytics enhance real estate investment decisions?

Analytics play a vital role in enhancing real estate investment decisions by providing data-driven insights. By utilizing advanced analytics techniques, investors can identify market trends, assess property performance, and evaluate investment risks more accurately. This leads to better forecasting and informed decision-making, allowing investors to optimize their portfolios, improve returns, and make strategic investments based on empirical evidence rather than intuition.

What key financial metrics should investors focus on when analyzing real estate models?

Investors should focus on several key financial metrics when analyzing real estate models, including Net Present Value (NPV), Internal Rate of Return (IRR), Cash-on-Cash Return, and Debt Service Coverage Ratio (DSCR). These metrics provide insights into the profitability and feasibility of investment opportunities, helping investors assess risk and make sound financial decisions. Understanding these metrics is essential for evaluating the overall performance and potential returns of real estate investments.

How can I learn to build and use advanced financial models for real estate?

To learn how to build and use advanced financial models for real estate, consider enrolling in specialized courses, workshops, or online tutorials focused on real estate finance and modeling. Practicing with real estate case studies and utilizing software tools or financial modeling platforms will also enhance your skills and confidence in creating effective models.

What common pitfalls should investors avoid when using financial models in real estate?

Investors should avoid several common pitfalls when using financial models in real estate, including over-reliance on assumptions, neglecting sensitivity analysis, and failing to update models with current market data. It’s crucial to challenge assumptions, consider various scenarios, and continuously refine models to reflect changing market conditions.

Article Disclaimer: This article provides general information about real estate and is not professional advice. Consult with a qualified professional before making any decisions. The creator is not liable for errors, omissions, or outcomes based on the information presented. Readers should always agree to seek personalized advice before making any real estate transactions.

Affiliate Disclosure: Please note that I am an affiliate marketer. This means I may earn a small commission at no extra cost to you if you purchase through my affiliate link. I only recommend products and services that I believe will bring value to you. Thank you for supporting my recommendations and allowing me to continue offering valuable content.