Blog / The Millionaire Real Estate Investor: The Book That Helped Me Develop My Real Estate Knowledge

The Millionaire Real Estate Investor: The Book That Helped Me Develop My Real Estate Knowledge

Published Date: August 23, 2024 - By Ebadul Haque

When I first started my journey as a real estate data analyst, I thought I knew a lot about real estate investing. I had worked with numerous landlords, property owners, and even closely collaborated with ezLandlordForms, a company that provided all the necessary tools for managing rentals.

Yet, I felt something incomplete. Despite my knowledge of leases, tenant screening, and eviction processes, I realized that there was still a vast ocean of investment strategies I hadn’t explored.

That’s when I stumbled upon a book that truly changed my perspective: The Millionaire Real Estate Investor by Gary Keller, one of the best books on real estate investing.

The Beginning of My Journey:

I first heard about the book from a successful investor I was consulting with. He mentioned it casually, saying, “You know, if you really want to get ahead in this game, you need to understand the mindset behind it. The Millionaire Real Estate Investor was my starting point.” His words struck a chord with me. After hearing similar recommendations from others in the industry, I decided to dive in.

Little did I know that this book would become the cornerstone of my real estate education. From myths about money to developing investment strategies, The Millionaire Real Estate Investor became a personal mentor of sorts, guiding me through the intricacies of real estate investing.

Breaking Down Myths About Money and Investing:

One of the first things the book tackled was the myths that often hold people back from real estate investing. There’s this common misconception that you need to have a ton of money to invest in real estate, or that only people with financial degrees can understand it. I’ve met many clients who were paralyzed by these beliefs. But Keller’s book shattered these myths for me.

It wasn’t about how much money you had, but how you thought about money. The book encouraged me to adopt the mindset of a millionaire investor—one that focuses on opportunity and long-term wealth building. For instance, rather than seeing money as something that could run out, I began to view it as a tool that, when used wisely, could open countless doors.

Developing Criteria for Great Real Estate Investment Opportunities:

I used to think that any property in a good location was a potential gold mine. But this book taught me how to develop sound criteria for identifying truly great real estate investment opportunities.

It’s not just about the location or the property’s appearance—it’s about the numbers behind the deal. Keller’s approach, grounded in solid financial analysis, taught me how to evaluate properties based on cash flow, appreciation potential, and risk.

This shift in perspective became invaluable in my work as a data analyst. I started applying these criteria when evaluating properties for clients, helping them make better-informed investment decisions.

For instance, one client was eyeing a property that looked promising on the surface. But after running the numbers and analyzing the potential risks using the book’s strategies, I advised them to pass on it. They later thanked me when the market in that area took a downturn.

Mastering the Art of the Deal:

One of the biggest lessons from The Millionaire Real Estate Investor was learning how to zero in on the key terms of any transaction and negotiate the best possible deals. Before reading the book, I often assumed that the asking price was the final price. But Keller emphasizes that everything is negotiable, from the purchase price to the terms of the sale.

This mindset shift helped me guide clients more effectively. I began encouraging them to negotiate creatively, whether it was by asking for closing cost concessions, longer inspection periods, or even seller financing. The results were phenomenal. Deals that initially seemed out of reach became attainable simply because we were willing to negotiate better terms.

Building a Dream Team:

The book also emphasized the importance of surrounding yourself with the right people—your dream team. Real estate investing isn’t a solo endeavor; you need a network of professionals who can support your goals. This includes everything from real estate agents to mortgage brokers, contractors, attorneys, and even accountants.

I started building my own dream team, carefully selecting experts who not only knew their stuff but also understood my vision. It wasn’t just about hiring the most experienced people; it was about finding those who were aligned with my investment philosophy.

Over time, this network became an invaluable resource, helping me and my clients—navigate the complexities of real estate transactions with ease.

Proven Models for Success:

Finally, one of the book’s most valuable contributions was its focus on proven models and strategies used by millionaire investors. From tracking net worth to lead generation for properties, The Millionaire Real Estate Investor offers practical, actionable advice. I implemented many of these models in my own work and saw immediate results.

For example, the book’s strategy for building a pipeline of potential deals transformed how I approached property searches. Rather than waiting for the right property to pop up, I became proactive, constantly generating leads and expanding my network. This not only helped me in my role as a data analyst but also in my personal investment journey.

A Book Worth Reading:

If you’re serious about real estate investing, I feel free to recommend The Millionaire Real Estate Investor, one of the best books on real estate investing. It’s more than just a book—it’s a comprehensive guide that can transform how you approach the real estate market. Whether you’re a newbie investor or someone looking to refine your strategies, this book has something valuable for you.

The lessons I learned from this book helped me grow both personally and professionally. It shifted my mindset, honed my skills, and allowed me to provide even better value to my clients. If you’re looking to embark on a similar journey, do yourself a favor and pick up a copy. It just might be the best investment you make.

Whether you’re just starting or looking to take your investments to the next level, this book can be your blueprint to success. Don’t just dream of financial independence—take action now! Start your journey to becoming a millionaire real estate investor today!

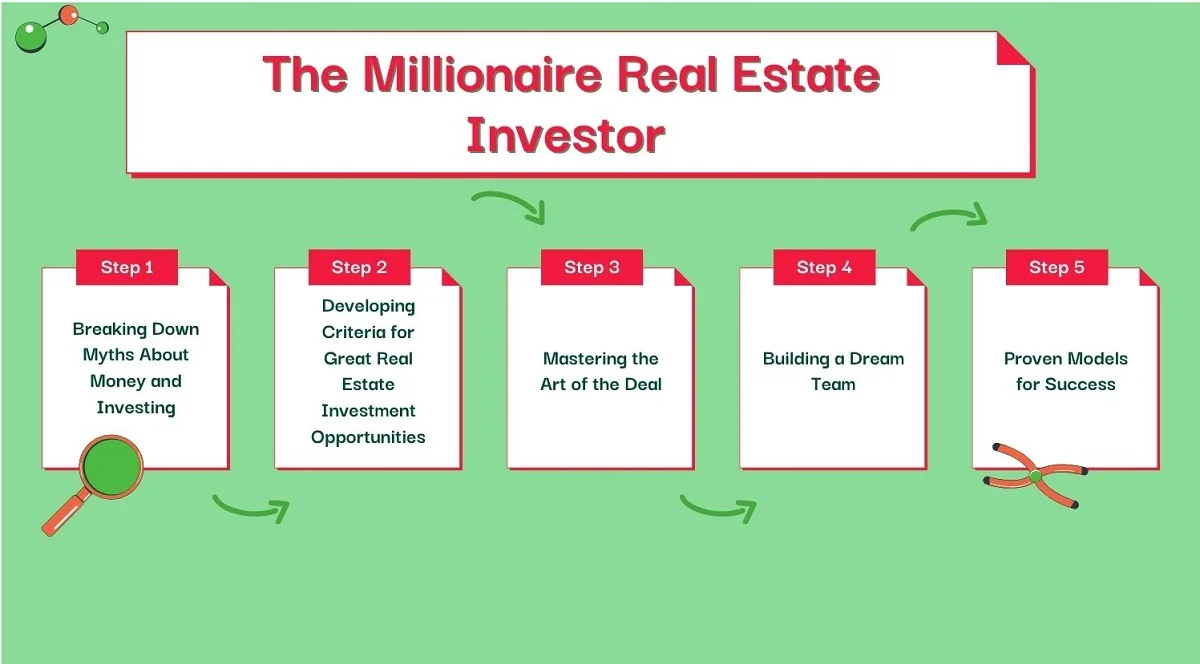

Key Takeaways:

- Breaking Down Myths About Money and Investing

- Developing Criteria for Great Real Estate Investment Opportunities

- Mastering the Art of the Deal

- Building a Dream Team

- Proven Models for Success

Frequently Asked Questions (FAQs):

What is The Millionaire Real Estate Investor about?

The Millionaire Real Estate Investor by Gary Keller provides a comprehensive guide to real estate investing, focusing on building wealth through proven strategies and the mindset needed for success. It breaks down common myths, helps readers identify great investment opportunities, and offers practical models for managing finances and growing a real estate business.

How did The Millionaire Real Estate Investor help you in your real estate journey?

The book helped me shift my mindset from just understanding real estate transactions to thinking like an investor. It taught me how to develop criteria for identifying high-quality investment properties, negotiate better deals, and build a dream team of professionals to support my goals. Implementing its strategies transformed both my personal investments and my ability to advise clients.

What are the key lessons you learned from The Millionaire Real Estate Investor?

Key lessons include debunking myths about money and investing, developing a millionaire investor mindset, identifying profitable real estate opportunities, mastering negotiation tactics, building a network of experts, and implementing proven models for tracking net worth, generating leads, and acquiring properties.

Who would benefit the most from reading this book?

Anyone interested in real estate investing, from beginners looking to get started to experienced investors seeking to refine their strategies, would benefit from this book. It provides practical advice and real-world examples that are applicable to a wide range of investment goals.

Is The Millionaire Real Estate Investor suitable for beginners?

Yes, the book is designed to be accessible to beginners. It starts with foundational concepts, debunks common misconceptions, and builds up to more advanced strategies. It’s a great starting point for those new to real estate investing who want to learn the ropes in a structured way.

How does The Millionaire Real Estate Investor compare to other real estate investing books?

While there are many great real estate investing books, The Millionaire Real Estate Investor stands out for its comprehensive approach. It covers not just strategies but also the mindset required for success. It also offers a unique blend of practical advice and proven models that can be directly applied to real estate investing, making it a favorite among both new and seasoned investors.

What is the millionaire mindset discussed in the book?

The millionaire mindset refers to shifting your perception of money, opportunities, and investing. It emphasizes seeing money as a tool to create wealth, rather than something to be hoarded or feared. It encourages strategic thinking, long-term planning, and viewing challenges as opportunities. This mindset is essential for becoming a successful real estate investor.

What practical tools does the book provide for real estate investors?

The book provides numerous practical tools, including strategies for evaluating properties, building a network of professionals, negotiating deals, tracking your financial progress, and generating leads. It also includes models used by successful investors to manage their portfolios and grow their wealth.

Can the strategies from The Millionaire Real Estate Investor be applied in today’s market?

Yes, while the real estate market evolves, the core strategies from The Millionaire Real Estate Investor remain relevant. The principles of identifying great opportunities, negotiating deals, and building a strong network are timeless. The book encourages adapting these strategies to current market conditions while keeping long-term goals in mind.

How has reading The Millionaire Real Estate Investor impacted your career as a real estate data analyst?

The book has significantly enhanced my ability to analyze properties and advise clients. It taught me to look beyond surface-level data and consider the financial and strategic aspects of real estate investments. This knowledge has helped me provide more valuable insights to clients and make smarter decisions about my own investments.

Affiliate Disclosure: Please note that I am an affiliate marketer. This means I may earn a small commission at no extra cost to you if you purchase through my affiliate link. I only recommend products and services that I believe will bring value to you. Thank you for supporting my recommendations and allowing me to continue offering valuable content.